|

December 28, 2018

Year End Tax Steps! Take an inventory of your product. If there is product which is expired, damaged or no longer sell-able for whatever reason, take it out of your inventory and mark your total cost as “spoiled”. This is a deductible expense. If you have the ability to sell your excess inventory at a slightly discounted rate do so. Holding large amounts of inventory at year end is not a Tax Advantageous strategy. Speaking of inventory, many companies are trying desperately to get rid of theirs. Now is the time for some smoking deals on computers, tablets, and those big screen monitors you’ve wanted. You will be able to deduct the cost of this business equipment 100% up to one million dollars. Car expenses, don’t forget that your car is a tax-deductible expense. Keep track of your miles! Business miles are not just to see a customer. Trips to events, the post office and to pick up inventory are deductible! Keep clear records. I use a phone app called Mile IQ which runs silently in the background. You can then classify your drives as business or personal at the end of the day. You will also want to track actual expenses to see whether the mileage or an actual expense deduction is the most Tax Advantageous strategy. Don’t forget your home office! A portion of your home is deductible. This is an often-overlooked tax strategy. As many of you may know, the Tax Code received its biggest overhaul in history on November 2, 2017, effective January 1, 2018. While many people will no longer have to itemize due to the larger standard deduction, it is imperative that business owners get the appropriate tax advice to take advantage of a new and largely misunderstood deduction called the Section 199A deduction, also known as a 20% Qualified Business Pass-Through Deduction. Many will be eligible for this potentially huge tax savings. Feel free to contact me offices if you have any questions. 702-233-6310 or send an email to: [email protected]

0 Comments

One per year rollover rule also applies to ESA's!

Crowdfunding has grown in the last 20 years raising billions of dollars from hundreds of projects being launched on a daily basis. Crowdfunding is the practice of soliciting financial contributions from a large number of people over the internet. These contributions can be used for a verity of projects. By doing this individuals and organizations can gain access to funds outside of the traditional sources like banks. Lets say you were involved in a terrible crash and needed to raise money to cover expenses so your sister opens a GoFundMe account online. You raise enough money thinking its a tax free gift. You don’t report the income on your tax return. Later on the IRS says you owe money in taxes, consisting of back taxes, penalties and interest. So is the money you receive from a GoFundMe fundraising campaign taxable income or tax free as a gift? Money raised in a GoFundMe account for the benefit of someone in need isn’t deductible as a charitable contribution. That shouldn’t effect whether the funds raised are taxable to the recipient. For another example think of a parent, parents aren’t a tax exempt charity. Yet there is no question that cash gifts from a parent to a child are tax free to the child. A GoFundMe account meets the definition of gifts under the Internal Revenue Code and would not be taxable to the recipient. But that doesn’t mean every donation qualifies as a gift. This is seen differently depending on what the donations are for. Money raised to support a profit motive, such as business are taxable to the recipient. But donations made to support disadvantaged individual would be considered a tax-free gift. Source: The Tax Book Photo: Pexels  Don’t be surprised when your employer withholds taxes from your paychecks. That’s how you pay your taxes when you’re an employee. If you’re self employed you may have to pay estimated taxes directly to the IRS on certain dates during the year. This is how a you pay as you go tax system works New employees need to fill out a W-4 form. An employee’s withholding allowance certificate is used to figure out how much federal income tax to withhold from your pay. The IRS withholding calculator tool on IRS.gov can help you fill out the form. Remember tip income is taxable. If you get tips, you must keep a daily log as you can report them . You must report $20 or more in cash tips in any one month to your employer. You must report all of your yearly tips on your tax return. A deduction may help lower your tax return. Money you earn doing work for others is taxable. Some work you do can count as self employment, like babysitting or mowing the lawn. Keep accurate records of expenses related to work. You may be able to deduct those costs from your income on your tax return. A deduction may help lower your taxes. If you’re in ROTC, your active duty pay, such as pay you get for summer camp, is taxable. A subsistence allowance you get while in advanced training isn’t taxable. You may not earn enough from a summer job to owe income tax. But your employer usually must withhold social security and medicare taxes from your pay. If you’re self employed you must pay them yourself. They count toward your coverage under the social security system. If you’re a newspaper carrier or distributor, special rules apply. If you meet certain conditions you’re considered self employed. If you don’t meet those conditions and are under the age of 18 you are usually exempt from social security and medicare taxes. You may not earn enough money from your summer job to be required to file a tax return. Even if that’s true you may still want to file. For example, if your employer withheld income tax from your pay you’ll have to file a return to get your taxes refunded. Source: IRS.gov Photo:Pexels  Charitable contributions are donations or a gift to or for the use by a qualified organization. It is voluntary and made without getting or expecting to get anything of equal value. Qualified organizations are nonprofit groups that are religious, charitable, educational, scientific or literary in purpose or that work to prevent cruelty to children or animals. In order for donations to be tax deductible the organization has to be qualified. Note: Gifts to individuals are never deductible as charitable contributions even if the individual is associated with a charitable organization. If the receipient of funds received uses the money for medical expenses, the receipient can deduct the cost of medical expenses within IRS tax guidelines. Fund used to help pay for other personal expenses are not deductible. There is no tracing rule under the IRC section 213 that requires tracing the source of the funds to some taxable source before being able to deduct the expense as a medical expense. Source: The Tax Book Photo:Pexels  Reduce your income taxes each year by taking advantage of the deductions available! Medical & Dental Expenses. These expenses in general are one of the largest expenses for retired people. Good news is that some of these expenses are deductible. If your expenses included health insurance premiums, long-term care insurance premiums, prescription drugs, nursing home care and other out of pocket health care expenses, they are deductible! But you need to itemize your deductions because there is a limit. People under the age of 65 the limit is 10% of your adjusted income. If you or your spouse is 65 and older then the limit is 7.5% until December 31, 2016. Certain Medicare Premiums Medicare Part A is not a medical expense. If you’re covered under social security you’re enrolled in Medicare Part A. If you’re not covered by social security you can voluntarily enroll in Medicare Part A and include the premiums you paid as a medical expense. Medicare Part B is a supplemental medical insurance and the premiums are a medical expense. Medicare Part D is a voluntary prescription drug insurance program and the premiums are a medical expense. Medical Expenses Paid for Relatives If certain requirements are met and you paid health premiums or uninsured medical expenses for a relative, its deductible. Generally you must pay over half of his or her support for the year. Selling your House If you lived in your main home for at least two of the five years before you sell your home the profit you make on the sale, up to $250,000 for single taxpayers and $500,00 for married taxpayers filing jointly is not taxable. Retirement Plan Contributions You can make deductible contributions to retirement plans such as IRAs. Those over 50 have higher contribution limits for tradition IRAs, Roth IRAs and 401(k)s. Retirees with their own businesses may also establish SEP-IRAs. Simple IRAs, Keogh plans and solo 401 ( K) plans that have higher contribution limits for those over 55. Charitable Contributions If you give back to the community by making charitable contributions some of those contributions are deductible as itemized deductions, subject to limitations. Cash contributions of up to 50% of your adjusted income are deductible each year. Source: Elder Law News Photo: Pexels  You must be able to itemize your tax return to take charity deductions. If you can’t itemize this year you can bunch your deductions and make your contributions next year. There are different types of donations. Cash Donations If you donate cash and don’t receive a receipt you don’t have a deduction. You can no longer deduct cash donations. You must have a cancelled check , bank record or receipt from the charity regardless of the amount you donate. If the donation is more than $250 a receipt is always REQUIRED. Non Cash Donations These can be shoes, clothes, books, furniture and appliances you donate. Unless in good condition the items will not qualify for a deduction. This means you need to add a notation labeling the condition of the donated items. You will also need a receipt from the charity along with your inventory. It is also a good idea to take pictures. Non Cash Donations over $500 but not over $5000 Your itemized inventory must also include when and how you came to possess the property. Examples are: purchase, gift, inheritance or exchange. Your records must also include original cost or other basis. Near Cash Donation These expenses occur when you make purchases for the benefit of the charity. Example buying supplies for Sunday school, canned goods etc. Besides having a receipt you must also have a receipt acknowledging the donation to the charity. Stock Donations Do you have stock that has appreciated in value? Give the shares to the charity. You wont have pay taxes on the capital gains and you will receive a charity deduction for the fair market value of the shares on the day of the gift. Source: The Tax Network Photo:Pexels  Are your investments subject to the 3.8% Net Investment Tax? It targets things like vacation homes and investment properties owned by high income individuals who exceed the threshold. This law requires a tax of 3.8% on the lesser of either your net investment income or the amount by which your modified adjusted gross income (MAGI) exceeds a certain threshold.

Here’s a few examples of what is generally included:

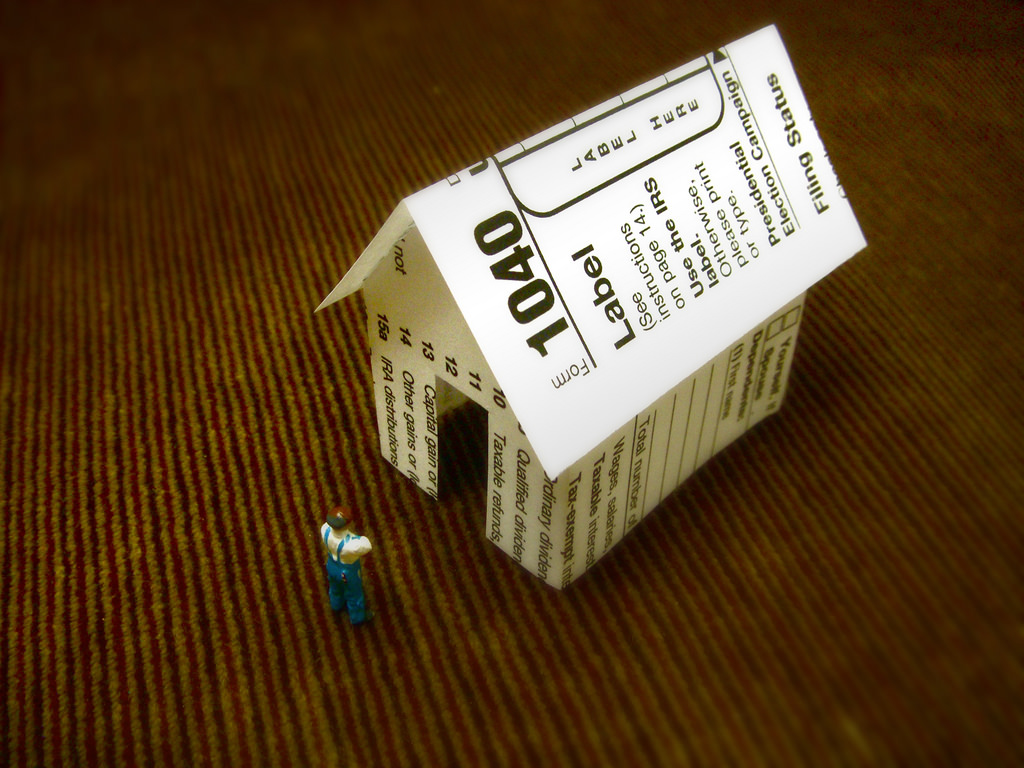

Please make sure to consult your personal CPA with question on the Net Investment Tax and how it pertains to you. But always BE TAX ADVANTAGEOUS! Source: American’s Tax Solutions / www.irs.gov It was once said, to me, that the smallest amount of money spent on a home would be the down-payment. I’m not sure that I agree but there are steps homeowners need to know to be most tax advantageous.

First, gather your documents – the last couple years’ tax returns and your home loan documents – and make an appointment with a tax professional. There may be an initial consultation fee but most apply it to the cost of completing and filing your federal tax return. Either way, the time and money you spend planning will save you in the end. As a homeowner you’ll be filing a 1040 Schedule A to be able to itemize costs of mortgage interest, property taxes, mortgage insurance and any points paid. These are items that you’ll be tracking. Additionally you’ll be able to itemize your charitable deductions. During your consultation make sure to review income and exemptions. It may be time to update your W-4 for you may be able to claim more exemptions. Remember that this is your time with a tax professional. Come with a list of questions and do not be afraid to ask. There are no stupid or silly questions when it comes to being tax advantageous! Photo credit: https://www.flickr.com/photos/jdhancock/3446025121 A donation is a gift. A (tax) deduction is variable tax dollars subtracted, (or deducted), from ones gross income.

Rules to Know…helping others helps you

So many rules to remember, and all you really wanted to do was clean out your closets and be able to park your car in the garage once more. Photo credit: https://www.flickr.com/photos/fhwrdh/4551794085 Even though we spend so much more time than before online interacting virtually we must get out and about – our customers and clients enjoy seeing us! So owning an automobile of some type is a necessity for business owners. And guess what…

The IRS is giving us a perk, a/k/a deduction. Beginning January 1, 2015, the IRS raised the standard mileage rate for car, van, pickup or panel trucks standard mileage rated from 56 cents to:

As taxpayers, we have the option of claiming actual mileage or operating costs. Mileage, of course, is the number of mile driven for business, and operating costs can include:

Making the decision, mileage or operating costs, is a discussion to have with your tax expert. Whichever way you chose you must keep track of your mileage! At the beginning of each year I write down (in a master business calendar) my car’s current mileage and then I continue to add appointments – making notes of where I went, who I met with and what was covered. Remember that the IRS loves documentation (and so does your CPA). Photo Credit: https://www.flickr.com/photos/pictures-of-money/17307620362

|

AuthorRhonda A. Mannes, Archives

December 2018

Categories

All

|

RSS Feed

RSS Feed