|

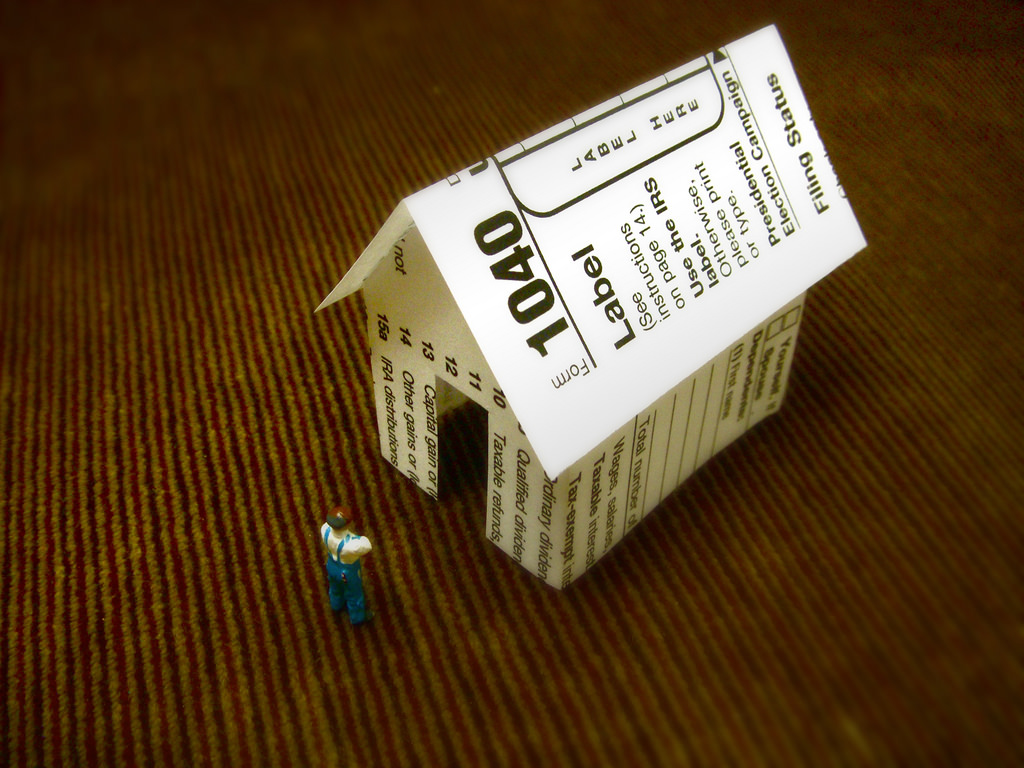

It was once said, to me, that the smallest amount of money spent on a home would be the down-payment. I’m not sure that I agree but there are steps homeowners need to know to be most tax advantageous.

First, gather your documents – the last couple years’ tax returns and your home loan documents – and make an appointment with a tax professional. There may be an initial consultation fee but most apply it to the cost of completing and filing your federal tax return. Either way, the time and money you spend planning will save you in the end. As a homeowner you’ll be filing a 1040 Schedule A to be able to itemize costs of mortgage interest, property taxes, mortgage insurance and any points paid. These are items that you’ll be tracking. Additionally you’ll be able to itemize your charitable deductions. During your consultation make sure to review income and exemptions. It may be time to update your W-4 for you may be able to claim more exemptions. Remember that this is your time with a tax professional. Come with a list of questions and do not be afraid to ask. There are no stupid or silly questions when it comes to being tax advantageous! Photo credit: https://www.flickr.com/photos/jdhancock/3446025121 |

AuthorRhonda A. Mannes, Archives

December 2018

Categories

All

|

RSS Feed

RSS Feed